Spain has 87,699 kilometres of pipelines, between mains and distribution networks, to carry natural gas to the homes of almost 1,800 councils. Particularly striking is the deployment of huge sums of money to build this extensive grid with which to distribute gas around the country. Paradoxically, one of the changes foreseen with the energy transition to mitigate climate change is to use more and more electricity to heat houses, using renewables.

Has a huge investment been made in a technology that may have an expiry date? The irony is not only about what has been built so far, but above all that there seem to be no qualms about continuing to lay pipes. The case of Menorca is particularly noteworthy: Naturgy (formerly Gas Natural Fenosa) has been awarded a contract to construct 578 km of pipes to bring gas to the island, a project that includes building three tanks to store the fuel, which would arrive by boat. "If they had proposed it to us 20 years ago, but now people think more about installing renewables," says Miquel Camps, director of the environmental organization Gob Menorca.

Houses on the island usually use butane, oil boilers and electricity. "The gas makes sense for industry, because it is less polluting, but in order for it to be significant and for the system to change gas has to be installed in thousands of houses and we don't see that there is demand. For a small saving in emissions with respect to the current system, it means laying 500 kilometres of pipes. It doesn't make economic sense, renewables are much more interesting," explains Camps.

The case of Menorca is a good illustration of the current contradiction: Spain has the best gas system in Europe, but in recent years has been warned, even by Government, that it is oversized, and that there is more capacity than is necessary. Demand slowed in 2008 coinciding with the economic crisis, and although it has recovered slightly, it has not reached the level of consumption for which the infrastructure was designed.

"Modernity was sold by exchanging butane for a pipe that can't be seen, but it doesn't make sense to bring natural gas to every house in the country," says Fernando Ferrando, an industrial engineer and economist, president of the Fundación Renovables, a think tank that has been working for years to accelerate the change from an energy model based on burning fossil fuels to a 100% renewable one.

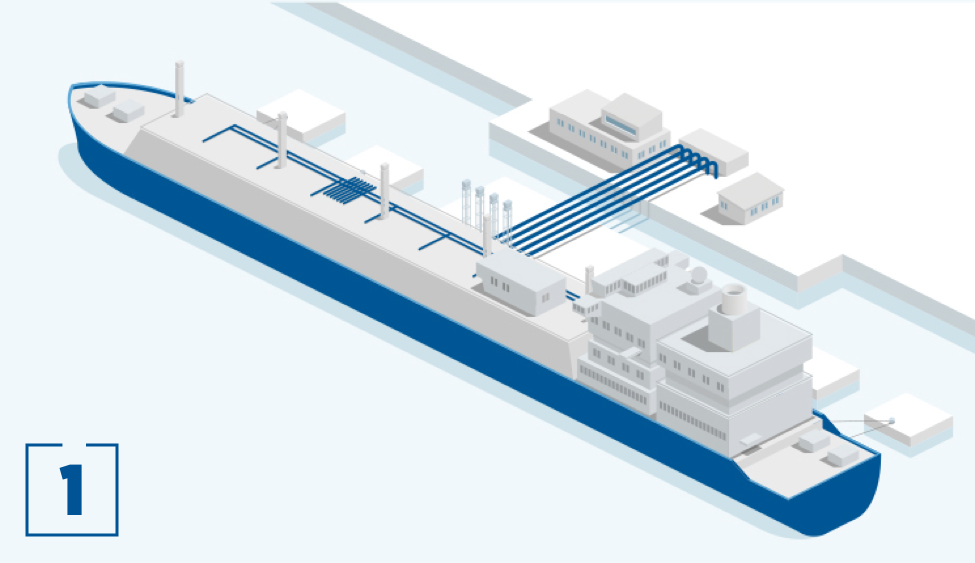

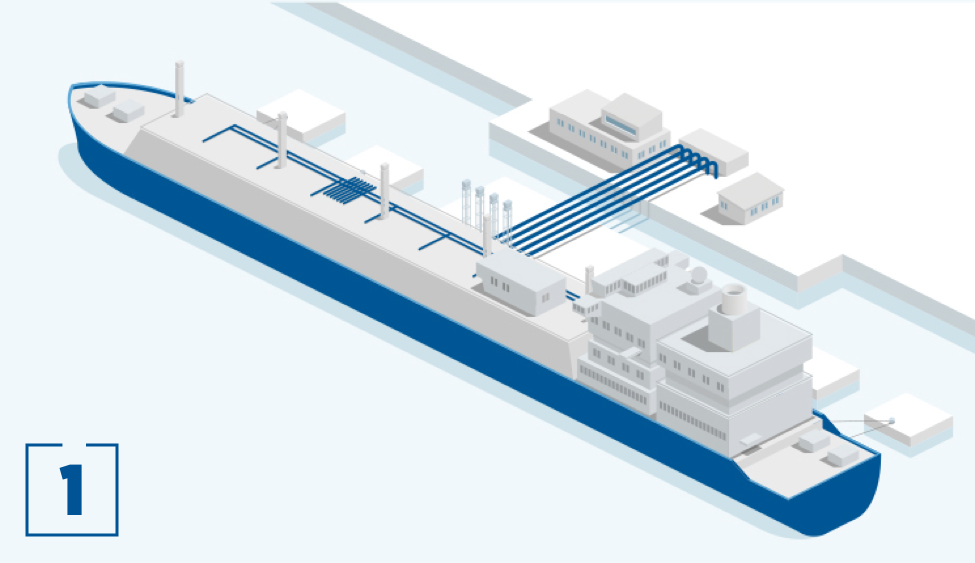

Spain barely has any gas of its own - gas extracted in the country represented just 0.3% of consumption in 2018 - but it has a gas system "of a luxury country, a Ferrari of gas", says an analyst and great connoisseur of the industry who prefers to maintain anonymity. Spain has the largest number of regasification plants in Europe, six active and one that has never come into operation and was mothballed due to overcapacity. These facilities represent 42% of the European liquefied natural gas storage capacity. In addition, Spain ranks third in capacity from combined cycle gas-fired power plants for electricity production.

While in many other European countries this fuel arrives by pipeline from Russia and elsewhere, here entry routes have proliferated to guarantee external supply: it enters through six international connections, two with Africa through Tarifa and Almeria, along the Maghreb and Medgaz pipelines, two with Portugal through Badajoz and Tuy, and two with France through Irún and Larrau. It also arrives via methane tankers that have six ports available. In total, 15 countries supply the incoming gas.

The issue is that the expansion of gas infrastructure was planned in anticipation of a demand that has not materialised. In recent years, it has been declining. In 2018, the combined regasification plants operated at 22% of their capacity. 2019, however, is a good year for gas. The scarce supply of hydroelectricity due to the lack of rain and the low price of this fossil fuel compared to coal, have led to more gas being consumed, especially to generate electricity. And perhaps things will improve for gas in future. The question is: if you want to eliminate CO2 emissions, this technology will have limits. Does it make sense to envisage the future energy model of a Ferrari?

"Gas runs the risk of being a stranded asset, today you don't need as much infrastructure as has already been built. Spain is the best example, but the same thing is happening in other European countries. In Belgium, the level of use of regasification plants is at 11.5%, there is overcapacity. And the problem is that these companies cannot change quickly, because their income depends on the infrastructure built," says Pascoe Sabido from London, a researcher at Corporate Europe Observatory, an organization dedicated to analysing the European lobbying by different business sectors.

In Spain, this is the case with Enagás. The income of this company (5% owned by the State, the rest belongs to private investors, most of them international) from regulated activity depends fundamentally on the use of its assets (gas pipelines, regasification plants), and on the repayment that the State provides for these activities and for being the technical manager of the system. In this regard, it is striking that the remuneration paid by the State has been steadily increasing, despite the fact that consumption of gas has reduced in recent years. In the remuneration budget proposed by the CNMC for 2019, of the 2,952.9 million euros of ‘recognised costs’, i.e., for which the State is responsible, 390.5 million correspond to regasification. Of these, 23.6 million will be used to keep the regasification plant in El Musel (Gijón) hibernating, an installation that has never been used; and more than 100 million pertain to the deficit that has been dragging on the system since 2014.

Certainly, Enagás is not only active in Spain, it invests in infrastructure outside the country, but here in Spain it has a business guaranteed by the State, without risk. A very visible feature of this contradiction is the salary of its president, Antonio Llardén, who has run the company since 2007. Last year it amounted to 1.89 million euros, 5.7% more than in 2017, according to the National Securities Market Commission (CNMV). "Of course, it is paradoxical that in a company with a regulated activity and without risks the president has such a high salary," says one analyst. However, just as Naturgy had to acknowledge last year that its nuclear, coal and gas plants are worth half what they were previously valued at due to the loss of profitability, what about infrastructure with overcapacity? "Devaluing assets is a trend that is beginning to accentuate in the fossil energy sector," explains another analyst.

The majority of researchers agree that gas plays a role in the energy transition, as it provides a security that renewables still cannot guarantee when there is no sun or the wind does not blow. "But in reality, the gas industry is looking for new markets, for example in transport, yet this does not make climatic or environmental sense, it is a wrong approach to tackle the problem," stresses Pascoe from London.

The giant company Kodak, which dominated the world of analog photography, did not see the digital revolution coming and collapsed by continuing to invest in obsolete technology. In the energy sector, "what nobody expected was that renewables were going to grow so fast, and this is a fundamental factor," explains Fernando Ferrando of the Fundación Renovables. In a world with more clean technology gas is not needed so much to heat houses, nor for cooking or showering, as it would be better to use electricity. "The fight of the gas sector is that, as it has already built infrastructure, it now defends continuing to sell gas," continues Ferrando.

Thus we see that Enagás and Naturgy are the two companies that complain and threaten the most, the first about going to court, the second about stopping investment in new infrastructure, because the National Commission of Markets and Competition (CNMC) has proposed cuts. Last July, the CNMC agreed a proposal to cut payments for gas transport and distribution networks, which according to several calculations would mean a reduction of between 30% and 40% in the profitability of the businesses. The Fundación Renovables proposes going even further, and suggests that the transportation of gas is paid for by supply sales, not just by owning the pipes that carry it throughout the country.

Investing more in gas infrastructure does not seem to make much economic or environmental sense. The European Commission has just removed a new gas interconnection with Portugal from its list of Projects of Common Interest (PCI) – the electricity and gas interconnection infrastructure considered strategic. This list, which is approved every two years, also previously included a new connection with France called Midcat. But it was dropped at the beginning of the year because it was expensive and unnecessary. Pascoe Sabido is emphatic: "Instead of gradually reducing dependence on fossil fuels and moving towards a just transition, the interest seems to be in having a single gas market. The problem is that this leaves us in a fragile position, because the market will slide into unemployment if there is no gas, just as we are seeing with the exit of coal.”

"Modernity was sold by exchanging butane for a pipe that can't be seen, but it doesn't make sense to bring natural gas to every house in the country," says Fernando Ferrando, an industrial engineer and economist, president of the Fundación Renovables