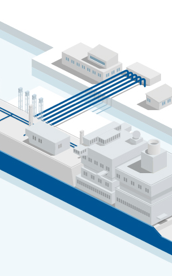

When one of the country's 7.8 million domestic gas consumers (20% of the total demand) turns on the heating, takes a hot shower or washes the dishes, they are paying to keep infrastructure on standby that has never been used, such as the El Musel regassification plant (Gijón), and for the deficit that has burdened the system since 2014 because too much infrastructure was built for the limited use it receives. But customers even pay if they do not use any gas at all. The leading five trading companies by sales volume - Naturgy, Endesa, Iberdrola, Unión Fenosa Gas and Cepsa– normally include in the fixed charge on their bills the costs of the gas and the use of the networks. But they do not show what these categories include. Some, like the one we show here, specify the word "tolls", which is key to understanding that between them, Spain’s consumers are covering the costs of excessive investments; and that because of this Spain has one of the highest gas prices in Europe. The tolls are what is paid for the development and maintenance of the gas system, that is, the infrastructure that either receives this fossil fuel by boat or pipeline from as many as 15 countries in 2018 (three more than in 2017) or that stores it or transports it to homes, businesses and factories. Spain barely produces any of its own gas.

The National Commission on Markets and Competition (CNMC) estimates that on average just over 40% of what homes pay in their bills goes towards covering the costs of the gas system.

.jpg)

What does this average of 40% paid by consumers for the gas system cover?

Things that have little to do with supply are charged. This includes the costs that the State recognises for the system, and that it therefore pays back. The costs are proposed every year by the CNMC and they include payments for regassification companies (Enagás), transport networks (Enagás), distribution networks (Naturgy) and the technical management of the system (Enagás). But they also include:

What impact does this underused luxury gas system have on the consumers' gas bill?

As stated by the CNMC in its 2018 report on the gas system, "the final price of gas for the domestic consumer (including taxes) is the fourth most expensive in Europe, mainly because of the higher cost of the tolls for the use of the network. If we consider the prices before tax, the price in Spain is the second most expensive in Europe".

.jpg)

How does the gas industry view the current situation?

In 2018, a total of 33 new municipalities were connected to the natural gas network. These figures come from industry group Sedigas. Currently, a total of 1,792 municipalities are supplied throughout the country, a number that has increased every year since 1985. The body concludes that "there is still large potential for growth", that is to say, keep building more distribution networks.

Does it make sense to continue building gas networks at a time of energy transition?

Right now, consumers pay in their bills for a system that was designed for a demand that has never materialised. There is more capacity than is needed, and even less will be required as more renewables enter into the system, the costs of which have fallen exponentially in the last five years.